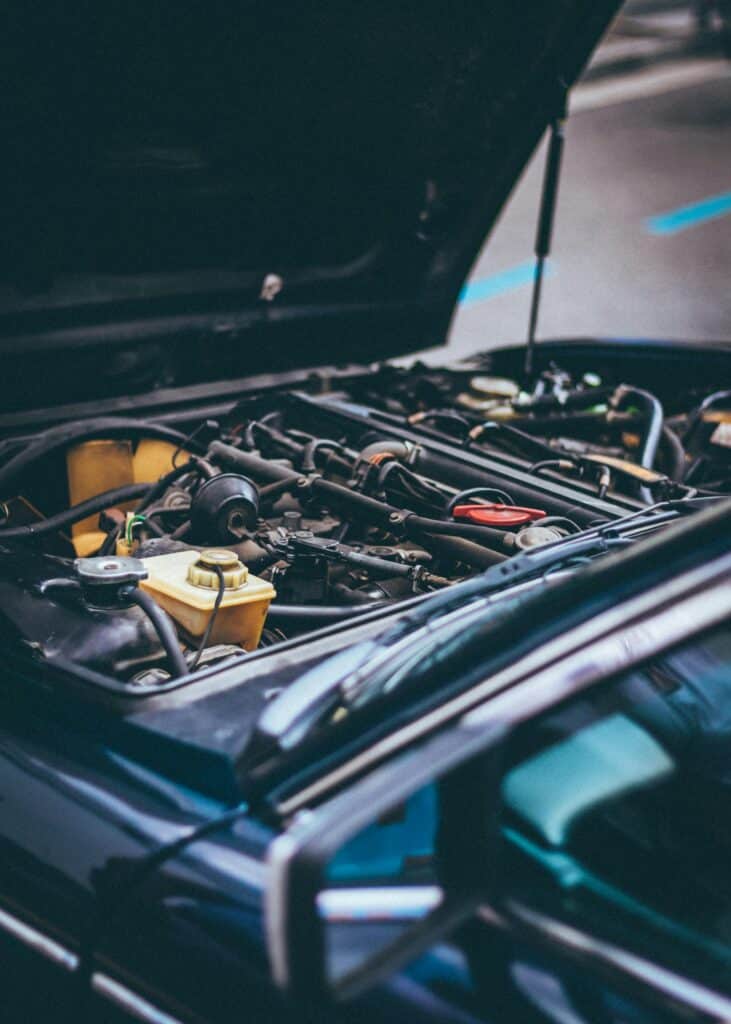

Vehicle repair insurance helps cover the cost of fixing major mechanical problems in your car, like engine or transmission failures. This article explains what vehicle repair insurance is, the types of repairs it covers, and whether it’s a good choice for you.

Vehicle Repair Insurance Overview

Vehicle repair insurance provides financial protection against costly mechanical breakdowns not covered by standard car insurance, such as engine failures, transmission problems, and electrical system malfunctions.

This insurance can be purchased as an addition to your existing policy or stand-alone, typically requiring a deductible before covering repair costs, with common coverage including air conditioning, heating, transmission, and brake systems. Alternatives to vehicle repair insurance, like extended car warranties and emergency repair funds, offer additional ways to manage repair costs, each with unique benefits that may better suit different financial situations and vehicle reliability concerns.

Understanding Vehicle Repair Insurance

Vehicle repair insurance, also known as mechanical breakdown insurance or auto repair insurance, is designed to cover the costs of repairing major mechanical components of your vehicle that aren’t caused by accidents or natural disasters. Unlike standard car insurance, which typically covers damages from collisions, theft, or weather-related incidents, vehicle repair insurance steps in to handle issues like:

- engine failures

- transmission problems

- electrical system malfunctions

- air conditioning and heating system failures

- suspension and steering issues

- brake system failures

These problems can arise unexpectedly and can be costly to repair. Vehicle repair insurance provides peace of mind and financial protection against these types of mechanical breakdowns.

This type of insurance offers car owners financial protection against significant repair costs that can otherwise be a major burden. Grasping the subtleties of how it operates, particularly how it diverges from other warranties and insurances, is valuable for making an informed decision tailored to your circumstances.

How Vehicle Repair Insurance Works

Vehicle repair insurance, also known as a car repair insurance policy, can be purchased as an addition to your existing car insurance policy or as a stand-alone product. When you opt for this coverage, you agree to pay a deductible, which is the amount you must pay out-of-pocket before the insurance kicks in to cover the remaining repair costs. The deductible can vary significantly depending on the insurer, with common amounts ranging from $50 to $500.

Once your deductible is met, the insurance covers the cost of repairing or replacing the defective parts. This can be particularly beneficial for major repairs like engine or transmission failures, which can be prohibitively expensive without coverage. Comprehending the deductible and claim process is pivotal because it directly influences your out-of-pocket expenditures when a mechanical problem arises.

Vehicle Repair Insurance vs. Extended Car Warranty

While vehicle repair insurance and extended car warranties may seem similar, they serve different purposes. Vehicle repair insurance, often less expensive, covers mechanical breakdowns and can be purchased from insurance companies. In contrast, an extended car warranty is typically a service contract provided by the car manufacturer or dealership, extending the coverage beyond the original warranty period.

Extended warranties often come with more comprehensive coverage and may include benefits like genuine parts and factory-trained technicians. However, they can also be more expensive and may limit repair options to specific service centers. Appreciating these distinctions aids in selecting the most suitable coverage for your needs.

What Does Vehicle Repair Insurance Cover?

Vehicle repair insurance, also known as car repair insurance cover, primarily covers major mechanical issues that can significantly impact your car’s performance. This includes problems with:

- the engine

- the transmission

- the electrical systems

- specific components like the cooling system and drive axle

Being aware of what is covered allows you to assess the value of this insurance and its potential protection against hefty repair charges.

It’s imperative to scrutinize your policy thoroughly to grasp the reach of the coverage. While some policies cover a broad range of mechanical and electrical problems, others might have more specific inclusions. This part will decode the typically covered repairs and emphasize the exclusions to paint a clear picture of what you can anticipate from your vehicle repair insurance.

Commonly Covered Repairs

Common repairs covered by vehicle repair insurance include issues with major systems such as:

- Air conditioning

- Heating

- Drive axle

- Transmission

- Brake system

- Electrical systems

- Emissions control

For instance, if your car’s air conditioning system fails or the transmission breaks down, these repairs would typically be covered under a standard vehicle repair insurance policy. These systems are crucial for maintaining your vehicle’s functionality.

Furthermore, labor costs associated with diagnosing and fixing these issues are usually included, making it easier to manage the financial burden of unexpected repairs. You should verify the specific details of your policy to confirm that these prevalent issues are covered.

Exclusions and Limitations

Vehicle repair insurance does have its limitations and exclusions. Here are some things that are not covered:

- Routine maintenance tasks such as oil changes, tire replacements, and brake pad changes

- Wear and tear from regular use

- Damages resulting from accidents, as these are typically covered by other types of insurance like collision insurance.

It’s also important to note that pre-existing damage or issues that existed before purchasing the insurance will not be covered. Being aware of these exclusions allows you to set feasible expectations and safeguards against surprise uncovered repair costs.

Eligibility for Vehicle Repair Insurance

Eligibility for car insurance coverage, such as vehicle repair insurance, often depends on the age and mileage of your vehicle. Insurers typically prefer newer cars with lower mileage, as these are less likely to have extensive wear and tear. Geico provides mechanical breakdown insurance for vehicles that are less than 15 months old and have fewer than 15,000 miles. This coverage is not available for older cars or those with higher mileage.

If your car exceeds certain mileage limits, insurers may remove the mechanical breakdown coverage from your mechanical breakdown insurance policy. This part provides guidance on whether your vehicle qualifies for this type of insurance and highlights factors that could impact your eligibility.

Cost of Vehicle Repair Insurance

The cost of vehicle repair insurance can vary, typically ranging from $30 to $100 per year. The specific cost depends on factors such as the vehicle’s age, mileage, and the selected deductible. A higher deductible generally results in lower monthly premiums, making it a flexible option for managing your budget.

Comprehending the cost structure is vital to ascertain whether this insurance is a sound investment. By balancing the annual premium with potential repair costs, you can make an informed decision about adding this coverage to your auto insurance policy.

Is Vehicle Repair Insurance Worth It?

Deciding whether car repair insurance worth investing in depends on several factors, including the cost of potential repairs and the reliability of your vehicle. Major repairs, like a transmission replacement, can cost thousands of dollars, making repair insurance a valuable investment for some car owners. However, if your car is new or still under warranty, this additional coverage might be redundant.

Balancing the premiums with the reassurance that you’re safeguarded for unexpected repairs is critical. Additionally, considering your financial situation and your car’s reliability can help you decide if car repair insurance is a prudent choice.

Financial Considerations

When evaluating if vehicle repair insurance is necessary, assess your ability to afford major car repairs without going into debt. If you find it challenging to pay out-of-pocket for expensive repairs, the monthly premiums for repair insurance might be a wise investment.

This financial buffer can shield you from substantial monetary stress when unexpected mechanical issues occur.

Assessing Your Vehicle’s Reliability

Researching the reliability of your vehicle can provide insights into potential mechanical issues and the likelihood of breakdowns. Resources such as Consumer Reports’ reliability guide can pinpoint prevalent issues with your car model, influencing your decision on whether to purchase vehicle repair insurance.

Alternatives to Vehicle Repair Insurance

While vehicle repair insurance offers significant benefits, there are alternatives worth considering. Extended car warranties and emergency repair funds are two such options. These alternatives can offer financial stability and possibly result in savings compared to vehicle repair insurance.

Extended warranties often offer comprehensive mechanical coverage and can be customized to fit your needs. Meanwhile, setting up an emergency repair fund allows you to save money specifically for unexpected repairs, giving you financial flexibility without relying on insurance.

Extended Car Warranties

Extended car warranties can extend up to eight years, offering comprehensive mechanical coverage through various protection plans. Dealership warranties often provide more extensive coverage, while independent providers may offer more flexible and affordable options.

These warranties can cover expenses beyond defects, including certain wear and tear, and may include the use of genuine parts and factory-trained technicians. Comprehending the varying levels of coverage and their advantages can guide you in determining if an extended warranty better suits your needs.

Emergency Repair Funds

Building an emergency repair fund involves:

- Setting aside a portion of your budget specifically for car repairs

- This approach provides a financial buffer without the need for additional coverage plans

- Giving you peace of mind knowing you have funds available for unexpected repairs.

By saving a small amount each month, you can gradually build a sufficient fund to cover routine maintenance and major repairs. This method can be a practical alternative to vehicle repair insurance, especially if you prefer to manage your finances independently.

Choosing a Vehicle Repair Insurance Provider

Selecting the right vehicle repair insurance provider involves considering several factors, including the provider’s reputation, customer service ratings, and transparency in their business practices. Researching customer reviews and ratings can give you insights into the provider’s reliability and the quality of their claims process.

It’s also vital to seek providers that present clear and thorough coverage details, making certain you comprehend what is and isn’t covered prior to making a purchase. This transparency can help you avoid surprises and ensure you get the protection you need.

Top Providers

Some of the top car insurance companies offering vehicle repair insurance include:

- Endurance: known for its comprehensive coverage

- CarShield: offers flexible payment options

- Rapid Auto Protection: known for competitive rates for comprehensive coverage

- Autopom!: stands out for its excellent customer service

- Olive: praised for its straightforward contracts and pricing as an auto insurance provider.

The selection of the right provider hinges on your specific requirements, like the quality of coverage, flexibility in payment, and customer service. Evaluating these factors can help you select a provider that best fits your requirements.

Questions to Ask Before Buying

Before purchasing vehicle repair insurance, ask potential providers about the different contract levels available, the specifics of what is covered, and their preferred repair shops for car repair insurance work. It’s essential to do your research before you buy car repair insurance to ensure you’re getting the best coverage for your needs, including various car repair insurance policies.

These inquiries can aid in making a well-informed decision and guarantee that the policy aligns with your needs and expectations.

Summary

In summary, vehicle repair insurance offers significant benefits by covering major mechanical issues that can be costly to repair. It’s essential to understand what is covered and the exclusions to evaluate its worth effectively. The decision to purchase this insurance should be based on your vehicle’s reliability, financial situation, and whether alternative options like extended warranties or emergency repair funds might be more suitable.

Ultimately, vehicle repair insurance can provide peace of mind and financial protection against unexpected repair costs. By considering all factors and exploring your options, you can make a well-informed decision that best suits your needs and circumstances.

Frequently Asked Questions

What is vehicle repair insurance?

Vehicle repair insurance, also known as mechanical breakdown insurance, covers the cost of repairing major mechanical components of your vehicle not caused by accidents or natural disasters. It offers financial protection for unexpected repairs.

How does vehicle repair insurance differ from an extended car warranty?

Vehicle repair insurance covers mechanical breakdowns and can be purchased from insurance companies, whereas an extended car warranty is a service contract provided by the car manufacturer or dealership, extending coverage beyond the original warranty period.

What are common exclusions in vehicle repair insurance?

Common exclusions in vehicle repair insurance include routine maintenance tasks, wear and tear, and damages from accidents.

How much does vehicle repair insurance typically cost?

Vehicle repair insurance typically costs between $30 to $100 per year, with the deductible amount affecting the overall policy cost.

What should I consider when choosing a vehicle repair insurance provider?

When choosing a vehicle repair insurance provider, consider their reputation, customer service ratings, and transparency in business practices, as well as the clarity and comprehensiveness of their coverage details. This will help you make an informed decision about the provider.